Finance Options Now Available On All Dynabrade Tools

DynaShop has recently partnered with a well-known and highly reputable financing company to be able to offer finance packages on all Dynabrade tooling.

What Is Financing?

A finance agreement is a contract between you and the finance company, whereby they will purchase the goods on your behalf and supply them to you on the understanding that you will make monthly repayments for the agreed term of either 2, 3, 4 or 5 years. These monthly repayments will not increase regardless of changes in interest rates or inflation.

The goods will be delivered to you once the agreement is approved and in place, at which point the monthly payments will begin. Until the full amount is settled the title to the goods will remain with the finance company, subsequent to which if you make one extra payment of the monthly amount the full title will pass to you. Alternatively you can renew the agreement for the same set term, whereby your old tooling will be replaced with brand new equipment.

What Are The Benefits Of Financing?

- Improve your cash flow position – no deposit is required so your only outgoing will be the monthly repayments

- No security is required – the finance company retains the title to the goods for the duration of the agreement, so they do not require any further security such as business assets

- Pay as you earn – use your purchased equipment to generate income for repayments, rather than having recoup the costs of a lump sum in the long-term

- Monthly repayments are a set amount regardless of inflation or interest rates – your monthly costs will not increase, enabling you to budget your cash flow more accurately

- Terms available of 2, 3, 4 or 5 years – the longer the term the lower the monthly repayments, which means you can choose based on the most affordable option for you

- Tax advantages – lease payments are often considered an allowable business expense, which means they can attract tax relief throughout the duration of the agreement

Do I Qualify?

Finance options are available to blue-chip companies and established limited companies who have been trading for 3 years or more. The finance company will perform their own checks, on the basis of which they will then either approve or reject the application.

How Do I Apply?

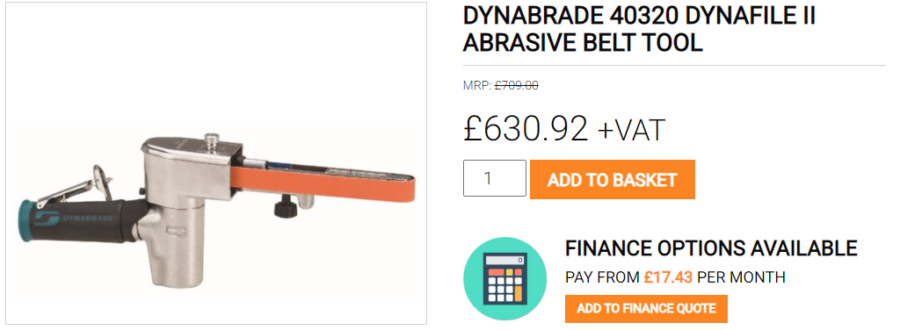

Finance options are available for Dynabrade tooling & machinery, and not for spare parts, accessories or abrasives. The total cost of a quote must exceed £1,000 +VAT in order to qualify for financing.

There is a section on the product page for all applicable tools, which is located under the ‘Add to Basket’ button and allows you to add this to a finance quote.

Once you have added a tool it will take you to a breakdown of your saved quote, from which you can then navigate away to other tools and add these too. This means you can essentially compile a finance quote for all of the equipment which you require, and then see the payment options for all of these as one combined purchase.

Once you have put your quote together you then have two options; if you simply wish to receive a copy of it for now then you can fill out the form on the Finance Quote page and click ‘Download Quote’, which will send you the details of your quote.

Alternatively, if you wish to proceed with an application for financing then you can click the ‘Apply for Finance’ button. As well as sending you a copy of the quote it will also forward this to us, at which point we will get in touch with you to confirm any further details before we provide your application details to the finance company. From the point which they receive a complete application they aim to approve this (if applicable) within 2-4 hours.